Our Business Model

Our Business Model

- United Oil & Gas plc

- About Us

- Our Business Model

We are and oil and gas company. United’s business model is to hold assets within the oil and gas life cycle to deliver value for the shareholders.

We review our portfolio regularly and our assets are monetised at different stages of oil and gas exploration, and development to optimise the portfolio and value creation.

What we need to execute our business model

Our people, our strengths and capabilities

- Business ethics and integrity

- Highly skilled subsurface, commercial, and finance teams who have

considerable experience with capital markets - A track record of delivery

- Strong industry relationships

Our assets & portfolio

- In Jamaica, we have an estimated 2.4 billion barrels unrisked mean prospective resources across the basin.

- Onshore UK, we have the Waddock Cross oilfield, with 57 million barrels of oil in place.

- We actively manage our portfolio to optimise commercialisation opportunities.

- We look to grow by pursuing new venture opportunities that meet our investment criteria.

- We commit to working responsibly across all our activities. This means working in a safe, secure, environmentally, and socially responsible manner.

Financial flexibility and resilience

- We have a balanced capital allocation policy between development and high impact exploration assets.

- Work programmes for our current portfolio are funded by cash on the balance sheet.

- We have access to capital markets and have established relationships with debt and equity providers.

What we do

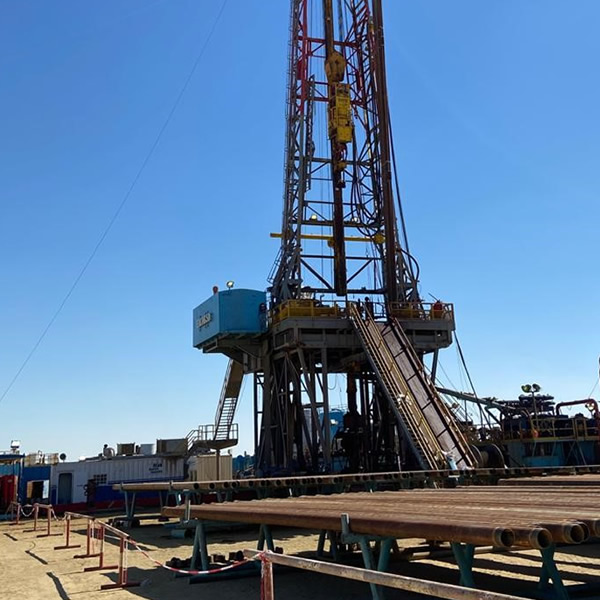

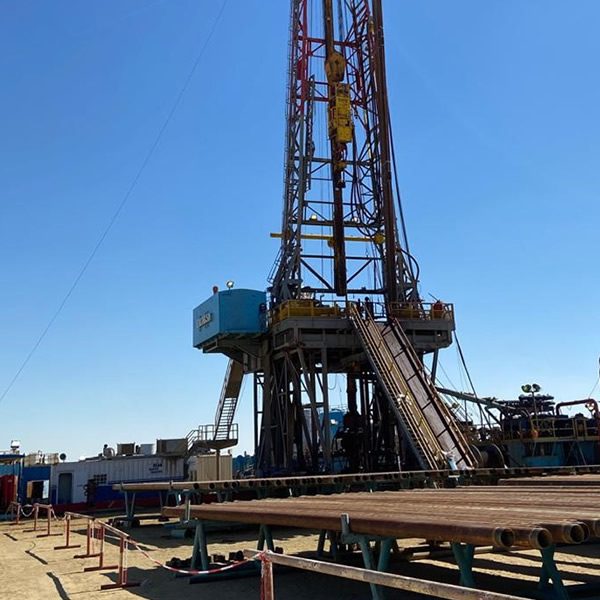

Develop and explore

We drill wells with our Joint Venture Partners on existing discovered reserves and resources. We explore for oil and gas in our existing licences. We conduct operations responsibly and safely.

Grow

Organic growth through disciplined and careful reinvestment into existing assets that will generate value. Inorganic growth via acquisitions with a focus on production.

Monetise

We assess our portfolio regularly and look for commercialisation opportunities that can be monetised at different stages of the oil and gas cycle.

Responsible value creation

We are committed to making a positive contribution, wherever we do business by delivering tangible benefits to our stakeholders. This includes the value distributed through salaries, taxes, payments to authorities, contractors and suppliers, capital spending and social investment.

Shareholders and financing partners

Oil and Gas revenue and cashflows

Employees

Zero incidents recorded for LTI’s

Salaries and benefits

Business partners and suppliers

Joint operating company has contributed to national economic growth through local sourcing , employment and using local suppliers

Governments and regulators

Payments to Governments via royalties, taxes and levy’s

100% of oil/gas produced is sold domestically

Local community investment

Social Investment into capacity building

Joint operating companies, have contributed to national economic growth through local employment , training and industry upskilling